注册新加坡公司,你该掌握哪些信息点?

1、公司注册至少需要一位本地董事

新加坡公司注册资格非常简单,就注册申请资格来说: 不论任何国籍的人,只要年满18周岁以上,都可以注册成立新加坡公司。如果是私人有限责任公司,股东方面无限制,甚至可以全部是非新加坡人。董事可以由一名或者多名组成,但必须至少有一位是本地居民董事(新加坡公民、永久居民、就业准证或家属准证持有者)。也就是说,如果申请注册新加坡公司均为新加坡居民人士,只有一位董事是可以的; 如果说注册新加坡公司申请人均为新加坡境外人士,必须拥有至少2名董事(包括1名本地居住权的挂名董事)和1名股东。挂名董事通常不占股份,也不参与经营。不过别担心,Elite Stage作为秘书服务公司,可提供挂名董事。2、主管机构:ACRA

新加坡会计与企业管制局(英文简称“ACRA”),是新加坡私人有限责任公司注册的唯一的主管及注册机构。

3、公司名称必须是英文

新加坡公司的名称必须是英文。这个拟注册的公司名称需要查册,不能和现有已注册成立的公司名称重复。4、标准法定股本

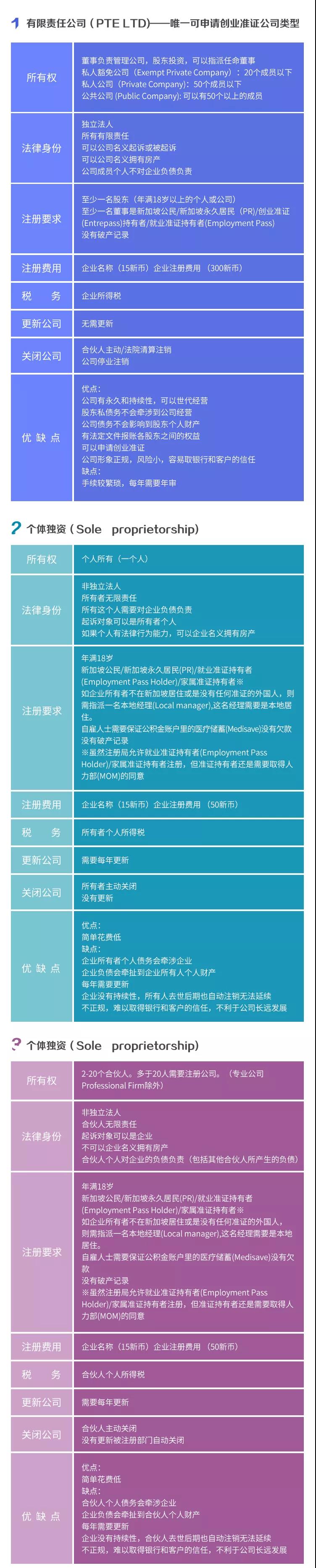

注册资本最低1元新币起,最高没有上限5、常见的公司类型

1.Housing expense

2.Education expense for children

3.Language training expense

4.Meal fee

5.Laundry fee

6.Relocation expense

了解这些基本知识点后,需要准备哪些资料来注册呢?Elite Stage会收集下列文件以帮助您注册公司:

01 非新加坡居民(外国人)

护照副本 海外住址证明“认识你的客户”(KYC)资料,如银行证明信、个人和商业资料等。02 新加坡居民

新加坡公民、永久居民、就业准证或家属准证持有者证件副本03 公司实体股东

注册文件副本,如公司注册证书和公司章程。办理完成后您将收到如下资料:

① 公司注册资料信息一份② 公司股东股票③ 公司章程正本2份④ 公司固定商业注册地址⑤ 公司注册证书(相当于营业执照)⑥ 公司钢印1枚、公司商业印鉴1枚

Three-year transition period for non-China domiciled tax residents

新加坡地理位置优越

具有国际贸易和税率优势

2.The six additional itemized deductions.

2.Continuing education expenses

3.Housing mortgage interest

4.Housing rent

5.Healthcare costs for serious illness

6.Expenses for taking care of the elderly

The two policies cannot be simultaneously enjoyed by non-China domiciled tax residents during the transition period. And once decided, non-China domiciled tax residents cannot change their preference within a given tax year.

According to the Notice, after the three-year transition period, that is starting January 1, 2022, non-China domiciled tax residents will no longer enjoy preferential tax-exemption policies on benefits-in-kind, including housing, language training, and children’s education.

Instead, the three categories of benefits-in-kind will be replaced by the corresponding additional itemized deductions (that is, housing rent, continuing education expenses, and children’s education expenses).

However, as to the remaining five categories of benefits-in-kind (namely meal fee, laundry, relocation expense, business travel expense, and home leave expense), the policy has not clarified whether they may continue to be tax-exempt.