香港公司免缴利得税之离岸豁免(最新规定+条件+案例+流程)

一、什么是香港离岸豁免

香港的税收基本原则之一是对离岸收入不征税,只就来源于香港的利润征税。如果利润不在香港产生,企业可以申请离岸豁免。

简单来说,即使在香港成立有限公司,只要公司的利润不来自于香港,便可在申报利得税时同时向香港税局申请离岸收入豁免。

需要注意的是,2023年1月1日新生效的“外地收入豁免征税”机制,对传统香港控股公司架构产生了重大影响。在该机制下,一些特定的 “指明外地收入 ,” 如跨国企业集团成员的离岸利息、股息、处置收益或知识产权收入,可能会被视为来源于香港,因此需要缴纳利得税。不过,若跨国企业集团满足相关豁免条款(如经济实质要求、关联要求和持股要求),这些指明外地收入仍可申请豁免。离岸豁免相关规定1. 受涵盖的纳税人:在香港经营业务的跨国企业集团成员。

2. 受涵盖的收入:无法满足“实质经济要求”的四种被动收入,即在香港收取的离岸股息、利息、处置收益和知识产权收入。“实质经济要求”指的是纳税公司需有足够的合资格员工并达到一定的经营支出要求。

3. 豁免征税条件:只要相关持股少于5%,公司被动收入不超过50%,且公司负责人为香港居民或在香港设有常设机构的非香港居民,便可获得豁免。

总结:在新生效的外地收入豁免机制下,只有满足上述特定条件,香港以外的离岸被动收入才能继续享受免税。

香港的税收基本原则之一是对离岸收入不征税,只就来源于香港的利润征税。如果利润不在香港产生,企业可以申请离岸豁免。

简单来说,即使在香港成立有限公司,只要公司的利润不来自于香港,便可在申报利得税时同时向香港税局申请离岸收入豁免。

需要注意的是,2023年1月1日新生效的“外地收入豁免征税”机制,对传统香港控股公司架构产生了重大影响。在该机制下,一些特定的 “指明外地收入 ,” 如跨国企业集团成员的离岸利息、股息、处置收益或知识产权收入,可能会被视为来源于香港,因此需要缴纳利得税。不过,若跨国企业集团满足相关豁免条款(如经济实质要求、关联要求和持股要求),这些指明外地收入仍可申请豁免。离岸豁免相关规定1. 受涵盖的纳税人:在香港经营业务的跨国企业集团成员。

2. 受涵盖的收入:无法满足“实质经济要求”的四种被动收入,即在香港收取的离岸股息、利息、处置收益和知识产权收入。“实质经济要求”指的是纳税公司需有足够的合资格员工并达到一定的经营支出要求。

3. 豁免征税条件:只要相关持股少于5%,公司被动收入不超过50%,且公司负责人为香港居民或在香港设有常设机构的非香港居民,便可获得豁免。

总结:在新生效的外地收入豁免机制下,只有满足上述特定条件,香港以外的离岸被动收入才能继续享受免税。二、离岸豁免申请条件

6. 不在香港进行市场推广、广告、宣传、销售及质量监控等活动。若同时满足上述条件,基本可以成功申请免税。

三、离岸豁免申请资料

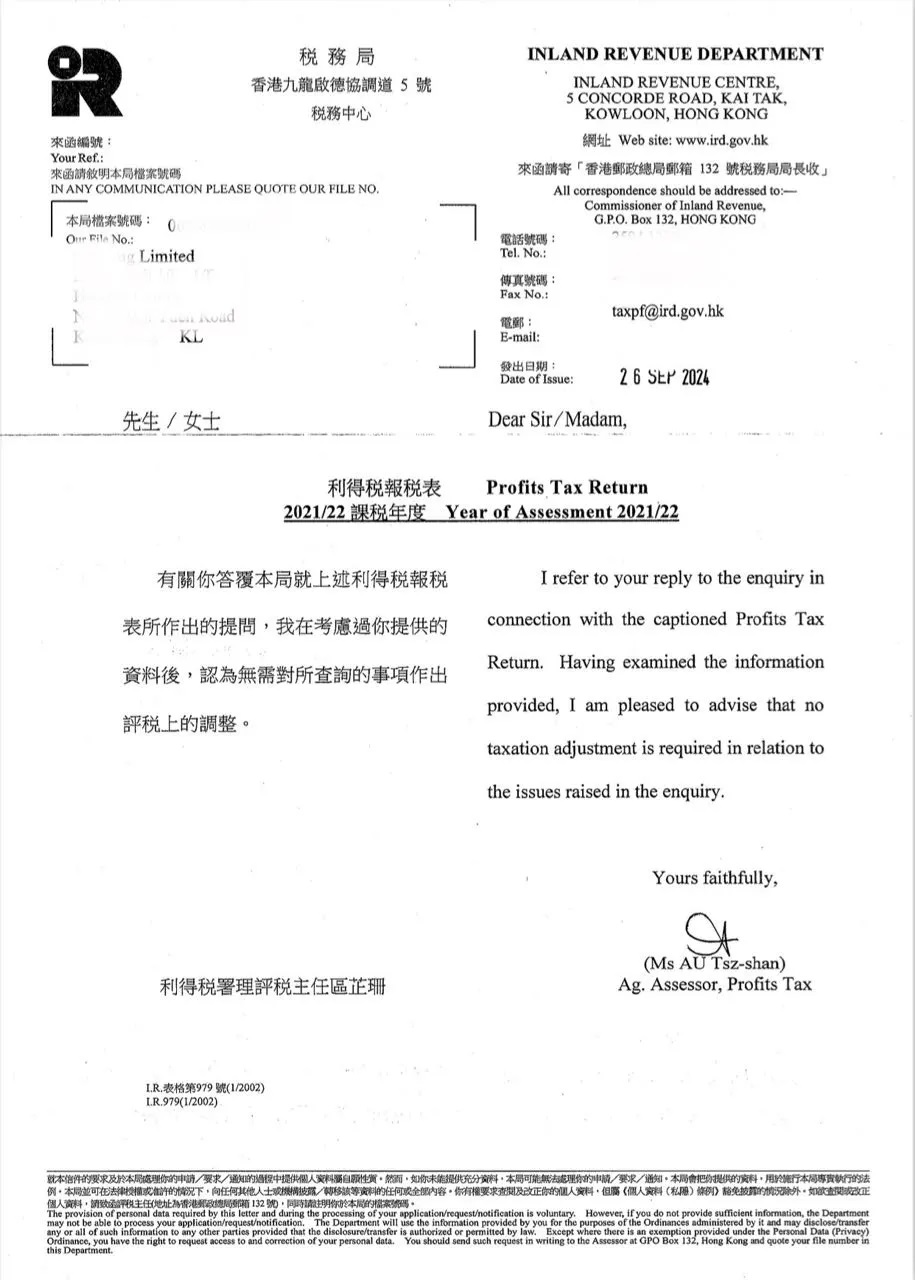

四、离岸豁免申请流程

离岸利润豁免的十大疑问解答