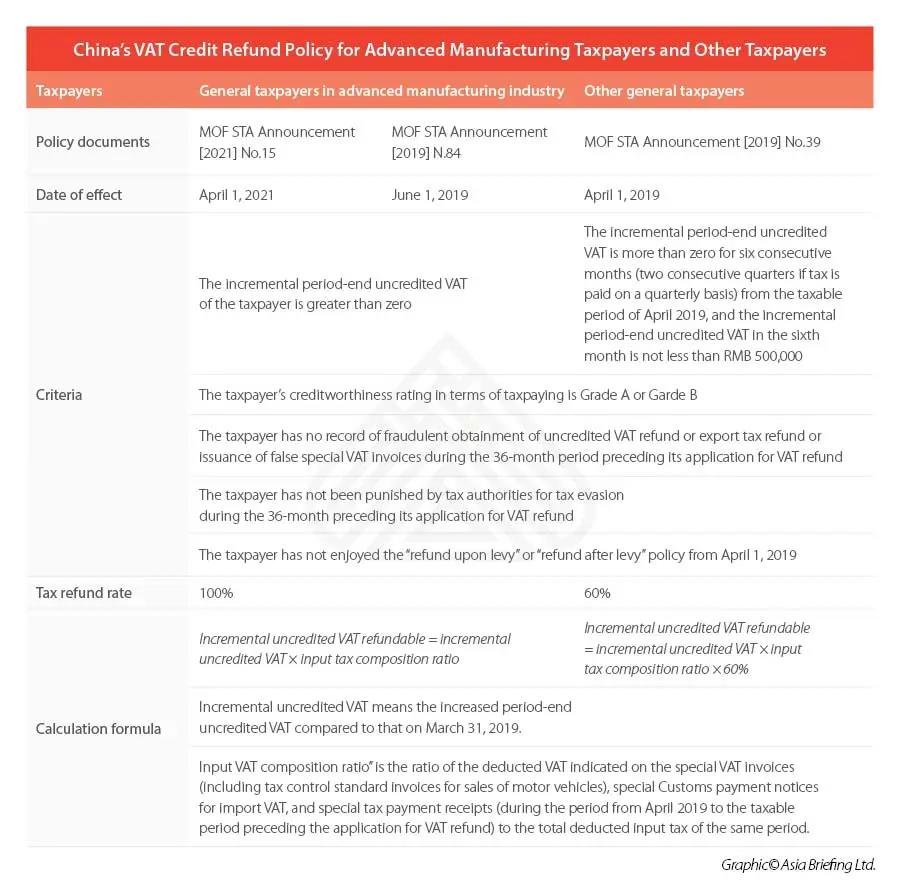

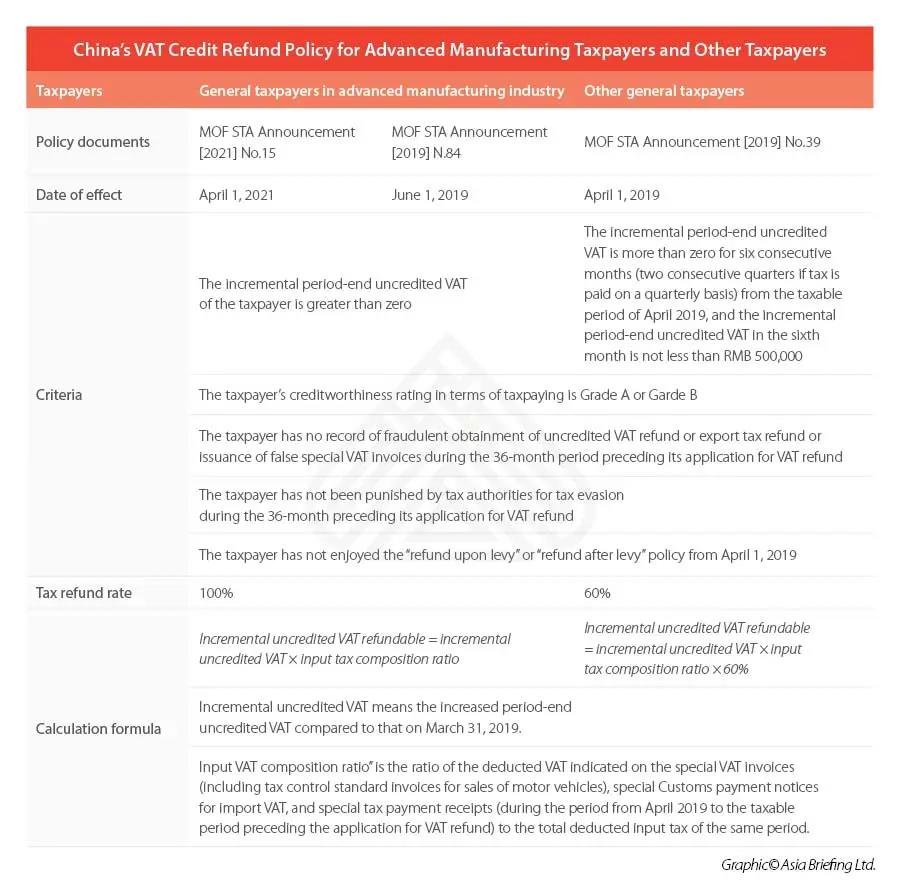

On April 28, 2021, China’s Ministry of Finance (MOF) and State Taxation Administration (STA) released the Announcement on Clarifying Policies on the Refund of Period-End Uncredited Value-Added Tax in Advanced Manufacturing Industries (MOF STA Announcement [2021] No.15), which took effect retroactively from April 1, 2021.This year, the country expanded the scope of advanced manufacturing taxpayers eligible for the VAT refund policy, benefiting another five sectors, including pharmaceuticals, chemical fiber, railway, vessel, aerospace and other transport equipment, electrical machinery and equipment, and instruments and meters.What is the period-end uncredited VAT?As we know, the VAT payable for a general taxpayer equals to the output VAT deducted by the input VAT in the current taxable period:VAT Payable = Current OutputVAT- Current Input VATAt the end of one taxable period, when the taxpayer’s current output VAT is less than the current input VAI,there is a negative balance, which is called the “period-end excess input VAT credit” or “period-end uncredited VAT”. Who are the advanced manufacturing taxpayers?An eligible advanced manufacturing taxpayer, referred to in the Announcement [2021] No.15, shall be a general taxpayer producing and selling the following nine categories of products, as defined in China’s Industrial Classification for National Economic Activities:Non-metallic mineral productsGeneral equipmentSpecial equipmentComputer, communication, and other electric devicesPharmaceuticalsChemical fiberRailway, vessel, aerospace, and other transport equipmentElectrical machinery and equipmentInstruments and metersHow to be eligible for the VAT credit refund?Same as before, the qualified advanced manufacturing taxpayer should satisfy all the following five conditions to enjoy the VAT refund policy:The incremental uncredited VAT of the taxpayer is greater than zero.The taxpayer’s creditworthiness rating in terms of taxpaying is Grade A or Grade B.The taxpayer has no record of fraudulent obtaining of uncredited VAT refund or export tax refund or issuance of false special VAT invoices during the 36-month period preceding its application for VAT refund.The taxpayer has not been punished by tax authorities for tax evasion during the 36-month preceding its application for VAT refund.The taxpayer has not enjoyed the “refund upon levy” or “refund after levy” policy from April 1, 2019.

China’s period-end uncredited VAT refund policyThese relaxed policies are undoubtedly a great benefit for qualified advanced manufacturing taxpayers, which will ease cash flow pressure and reduce the financial cost of taxpayers.For more tax information, we will host more online or off-line lectures, welcome to participate.In addition to the preferential policies mentioned above, China government has successively issued five batches of 23 preferential tax policies this year.