Singapore Immigration Soaring, Ways of Corporate Investment

In recent years, global investors have come to Singapore to invest, bringing huge investment income and employment to Singapore. The Singapore Economic Development Board (EDB) has announced new immigration regulations that significantly raise the investment threshold for obtaining permanent residency in Singapore through the Global Investor Program (GIP) and significantly increase the number of Singapore citizens who must be employed. The new regulations came into effect on March 15.

In recent years, global investors have come to Singapore to invest, bringing huge investment income and employment to Singapore. The Singapore Economic Development Board (EDB) has announced new immigration regulations that significantly raise the investment threshold for obtaining permanent residency in Singapore through the Global Investor Program (GIP) and significantly increase the number of Singapore citizens who must be employed. The new regulations came into effect on March 15.

The original requirement was that for a foreign immigrant investor to renew his re-entry permit, the applicant’s business must only employ at least 10 new employees, half of whom must be Singapore citizens, and have a total business expenditure of S$2 million.

The four investment categories are:

companies listed on an exchange licensed by the Monetary Authority of Singapore, such as companies listed on the Main Board of the Singapore Exchange and the Kelly Board.

eligible debt securities, including bonds, notes, commercial paper and certificates of deposit, etc.

funds issued by managers registered in Singapore.

an investment in unlisted companies in Singapore by way of private equity.

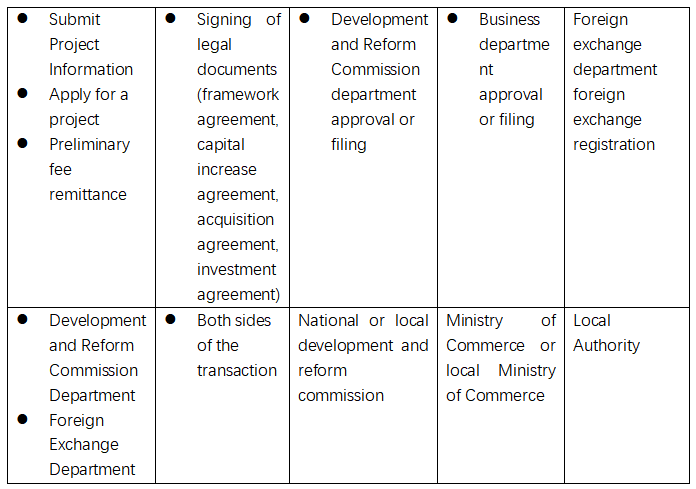

Relevant approval departments need domestic investment enterprises to submit due diligence, feasibility study report, description of the source of investment funds, investment environment analysis and evaluation of the implementation of the preliminary work description information, through the material to the project description of the demonstration for approval.

Except for the overseas investment projects of local enterprises registered in China (Shanghai) Pilot Free Trade Zone (hereinafter referred to as “Shanghai FTZ“).

The filing system will automatically send the information to the National Development and Reform Commission or relevant provincial development and reform departments for acceptance based on the type of enterprise, place of registration and the amount of Chinese investment in the project.

Login to the filing system

Login through the “Overseas Investment Project Record Management Network System” in the “Government Service Center” – “Online Office” section of the NDRC website.

Registration of enterprise user name

The application for user registration of central enterprises is accepted by NDRC, and the application for user registration of local enterprises is accepted by provincial development and reform departments.

Submit project filing information

After obtaining the user name and password, enterprises log in the filing system, fill in the overseas investment project filing form and upload relevant attachments as required, and submit the paper filing materials separately.

Acceptance and examination by corresponding authorities

The filing system will automatically send the project and enterprise information to the National Development and Reform Commission or provincial development and reform departments for acceptance.

Inform the review results

To fill in the material does not meet the requirements, the development and reform departments promptly feedback requirements to make up for the amendment; has passed or failed to review, promptly informed of the results. Through the record review of the project by the development and reform departments issued a paper “project record notice.

The Ministry of Commerce (MOFCOM) and the provincial commercial authorities will manage the overseas investment through the “Overseas Investment Management System” and issue the “Certificate of Overseas Investment” to the enterprises that have been filed or approved, which will be printed and stamped by MOFCOM and the provincial commercial authorities respectively and managed by a unified code.

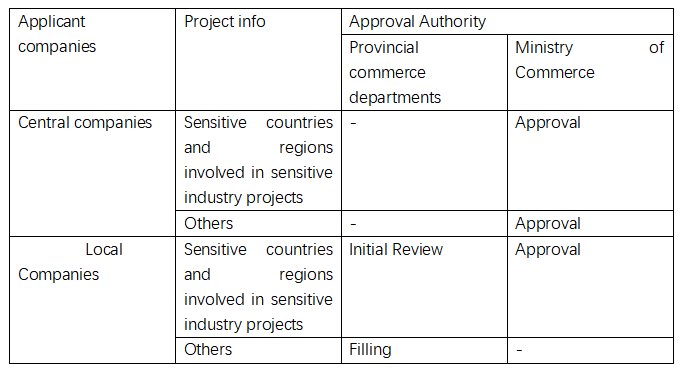

Specific approval and filing authority of the commerce department:

Central enterprises and local enterprises shall fill out and print the “Overseas Investment Filing Form” (hereinafter referred to as the “Filing Form”) through the “Management System” as required, stamp it and submit it to the Ministry of Commerce or the provincial commercial department for filing, together with a copy of the business license of the enterprise.

If the “Filing Form” is filled out truthfully, completely and in the statutory form, and the enterprise declares in the “Filing Form” that there is no overseas investment in the circumstances listed in Article 4 of these Measures, the Ministry of Commerce or the provincial department in charge of commerce shall file and issue the “Certificate” within three working days from the date of receipt of the “Filing Form”. If the enterprise does not fill in the “filing form” truthfully and completely, the Ministry of Commerce or the provincial department in charge of commerce will not file the form.

Approval Procedures and Conditions

For approved overseas investment, the central enterprise shall apply to the Ministry of Commerce, and the local enterprise shall apply to the Ministry of Commerce through the local provincial commercial department.

Enterprises applying for approval of overseas investment must submit the following materials:

Application form, mainly including the situation of the investment subject, name of the overseas enterprise, equity structure, investment amount, business scope, operation period, source of investment funds, specific content of the investment, etc;

Application Form for Overseas Investment, which should be filled out and printed by the enterprise through the “Management System” and stamped;

The contract or agreement related to the overseas investment;

The relevant departments of the overseas investment in the products or technologies that are restricted from export by the People’s Republic of China;

A copy of the business license of the enterprise.

Approval of overseas investment should seek the views of our embassies (consulates) in foreign countries (business offices). If the central enterprise is involved, the Ministry of Commerce shall consult; if the local enterprise is involved, the competent provincial commercial department shall consult. Consultations, the Ministry of Commerce and the provincial department in charge of commerce should provide basic information on investment matters. Embassies (consulates) abroad (business offices) should respond within seven working days from the date of receipt of the request for comments.

The Ministry of Commerce should be approved within 20 working days after receiving the application of the central enterprises (including the time to seek the views of foreign embassies (consulates) (and business offices)) to make a decision on whether to be approved. Application materials are incomplete or do not meet the statutory form, the Ministry of Commerce shall inform the applicant within 3 working days of all the content that needs to be corrected.

Late notification, from the date of receipt of the application materials, is accepted. Central enterprises in accordance with the requirements of the Ministry of Commerce to submit all the corrective application materials, the Ministry of Commerce shall accept the application.

The provincial commerce department shall accept the application for approval of local enterprises whether the application involves the circumstances listed in Article 4 of these measures for a preliminary review, and within 15 working days (including the time to seekthe views of foreign embassies (consulates) (business offices)) will be a preliminary review and all application materials submitted to the Ministry of Commerce.

Application materials are incomplete or do not meet the statutory form, the provincial department in charge of commerce should be informed within three working days of all the content to be corrected by the applicant enterprise. Late notification, from the date of receipt of the application materials, is accepted. Local enterprises in accordance with the requirements of the provincial department in charge of commerce to submit all the corrective application materials, the provincial department in charge of commerce shall accept the application. The Ministry of Commerce received the preliminary review of the provincial department in charge of commerce, which should be made within 15 working days to approve the decision.

Approval of joint overseas investment by two or more enterprises

If two or more enterprises jointly carry out overseas investments, the relative major shareholder shall seek the written consent of the other investors for filing or application for approval. If the shareholdings of the parties are equal, one of them shall apply for filing or approval after consultation. If the investors do not belong to the same administrative region, the Ministry of Commerce or the provincial commercial department responsible for the filing or approval shall inform the commercial department of the location of the other investors of the result of the filing or approval.

According to the latest “Notice of the State Administration of Foreign Exchange on Further Simplifying and Improving Foreign Exchange Management Policies for Direct Investment” of the State Administration of Foreign Exchange on February 13, 2015 (effective on June 1, 2015).

Since June 1, 2015, foreign exchange registration under overseas direct investment will be directly audited by banks, and the State Administration of Foreign Exchange and its branches will implement indirect supervision of foreign exchange registration of direct investment through banks.

Meanwhile, according to Article 10 of the Interim Provisions on Management of Equity Investment by Municipal State-owned Enterprises, the overseas equity investment and cross-border guarantee for overseas M&A financing by state-owned enterprises shall be considered in accordance with internal decision-making procedures and, after examination and approval by the funded enterprises, shall be reported by the funded enterprises to the SASAC for approval.