Offshore Exemption for Hong Kong Companies — Latest Regulations

In simple terms, even if a company is incorporated in Hong Kong, as long as its profits are not sourced from Hong Kong, it can apply for an offshore income exemption when filing profits tax returns.

Note: The new “Foreign-sourced Income Exemption” (FSIE) regime, effective January 1, 2023, has significantly impacted the traditional Hong Kong holding company structure. Under this regime, certain “specified foreign-sourced income,” such as offshore interest, dividends, disposal gains, or intellectual property income of multinational enterprise (MNE) groups, may be considered Hong Kong-sourced and thus taxable. However, if MNEs meet the related exemption conditions (e.g., economic substance requirements, nexus requirements, and holding requirements), these specified foreign-sourced incomes may still be eligible for exemption.

Offshore Exemption Rules:

Eligible Taxpayers: MNE members conducting business in Hong Kong.

Covered Income: Offshore dividends, interest, disposal gains, and IP income received in Hong Kong that do not meet the “economic substance requirements.” These requirements refer to having sufficient qualified employees and meeting certain operational expense thresholds.

Exemption Conditions: If a company holds less than 5% in shareholding, passive income does not exceed 50%, and the company’s responsible person is a Hong Kong resident or has a permanent establishment in Hong Kong, it may qualify for an exemption.

Summary: Under the new FSIE regime, only offshore passive income that meets specific conditions can continue to enjoy tax exemption.

Generally, to apply for offshore exemption, the following conditions must be met:

Sales and procurement activities (including negotiation and contract signing) are conducted outside of Hong Kong.

The company does not have an office, warehouse, or store goods in Hong Kong.

Orders from customers or suppliers are not processed in Hong Kong and require approval from management outside of Hong Kong.

Neither suppliers nor customers are Hong Kong companies or Hong Kong residents.

Pricing, decision-making, and sourcing activities do not take place in Hong Kong, and no employees are hired in Hong Kong.

No marketing, advertising, promotions, sales, or quality control activities are conducted in Hong Kong.

If the above conditions are met, the company is likely to succeed in obtaining a tax exemption.

For a typical trading company, the application documents include, but are not limited to:

1. Routine Company Documents: Such as registration certificates, articles of association, and shareholder agreements.

2. Business-Related Documents: These include sales contracts, purchase contracts, invoices, customs declarations, bills of lading, and shipping documents. The company must provide documentation for its largest business transactions. If the profits come from related-party trading, proof of these relationships is required. Additionally, product quotes, organizational structure charts, and detailed descriptions of Hong Kong and offshore operations must be provided, along with a transaction flowchart showing how offshore income is handled, and payment methods (e.g., wire transfer, cash, letter of credit).

Hong Kong companies must maintain all relevant documents related to offshore activities for potential review by the IRD. Once the tax authorities confirm the business model of the company, the company generally will not be subject to annual audits but may be reviewed through random checks.

2. Upon audit completion, the accountant will submit the offshore exemption application to the IRD based on the client’s wishes.

3. The IRD will request an audit report and supporting documents in writing. If there are any doubts, the company must respond within one month.

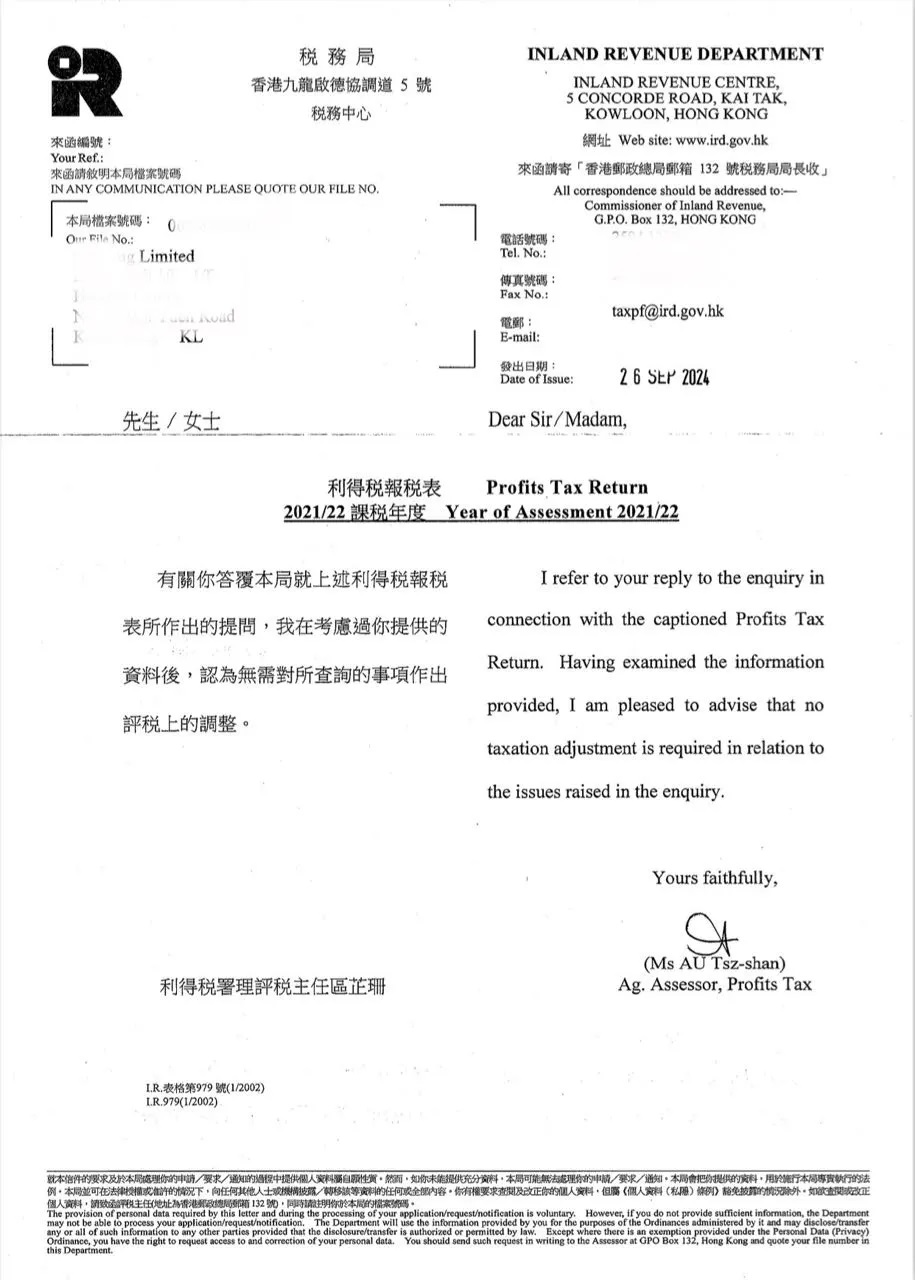

4. After assessment, if the IRD confirms the company operates offshore, it will issue an exemption letter.

5. Once the exemption letter is granted, the IRD will not review the company again for 2-3 years. After successfully obtaining the exemption, the company can legally leverage Hong Kong tax laws to exempt profits from offshore income, reducing operating costs and enhancing its ability to invest in other business ventures.

Answer: It depends on the company’s substantive operations and the scope of activities conducted in Hong Kong.

2. When do offshore companies need to pay tax?

Answer: If a company conducts business and earns profits in Hong Kong, it is subject to profits tax, regardless of its place of incorporation.

3. How does the tax authority determine if a company is conducting business in Hong Kong?

Answer: This is assessed on a case-by-case basis, considering the scale of operations and agency activities.

4. How is the source of profits determined?

Answer: It is based on the location and nature of profit-generating activities, with reference to the Departmental Interpretation and Practice Notes No. 21.

5. What filing requirements apply to offshore

companies conducting business in Hong Kong?

Answer: They must follow the same filing requirements as Hong Kong companies and keep records for at least seven years.Is an audit required

6. when submitting profits tax returns?

Answer: If the company is incorporated in a jurisdiction requiring audits, audit reports must be submitted.

7. Are royalties paid to offshore companies taxable?

Answer: Certain payments may still be subject to tax under the Inland Revenue Ordinance.

8. What special tax rules apply to offshore companies?

Answer: Non-residents have specific tax rules similar to Hong Kong companies.

9. Do offshore partnership businesses providing services in Hong Kong need to pay tax?

Answer: If the business operates and earns profits in Hong Kong, it is subject to profits tax.

10. How can companies ensure their activities are not subject to tax?

Answer: Companies can apply for an advance ruling under section 88A of the Inland Revenue Ordinance to clarify their tax situation.The offshore exemption application process can be lengthy, taking up to six months or longer, depending on the timeliness of responses and supplementary materials.