Understanding CPF &SDL as An Employer in Singapore

Ordinary Account: for retirement, insurance, housing and investments.

MediSave Account: For hospitalization expenses and approved medical insurance.

Special Account: for retirement and retirement-related financial products.

Retirement Account: for monthly retirement benefits for persons 55 years of age and older.

As an employer, the deadline for you to contribute is the last day of the month, but you must contribute by the 14th of the following month.

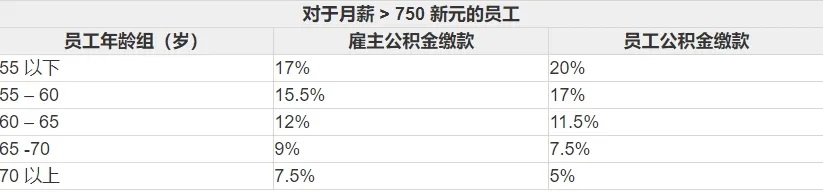

Employer contribution rates for 2025

The monthly CPF Ordinary Salary Limit has been increased twice since the implementation of the increase: from S$6,000 to S$6,300 on 1 September 2023, to S$6,800 on 1 January 2024, and to S$6,800on 1 January 2025, when the monthly CPF Ordinary Salary Limit will be increased to S$6,300 per month.

On 1 January 2025, the monthly CPF Ordinary Salary Limit will increase to S$7,400 per month. In other words, the annual CPF salary limit will remain at S$102,000, including Ordinary Salary and Premium Salary. The current maximum additional salary and annual CPF limit will also remain unchanged at S$102,000 and S$37,740 respectively. To simplify the new changes, here is a list of CPF contribution rates for 2025:

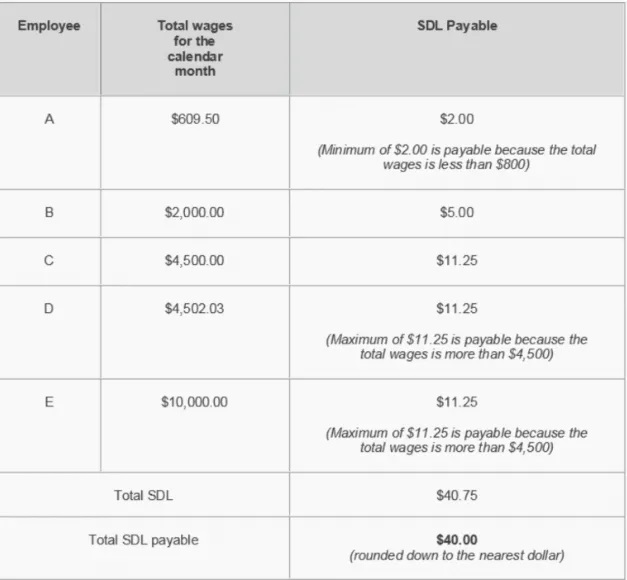

Gross monthly wages include any salary, commission, bonus, holiday pay, overtime, allowances and other cash payments.

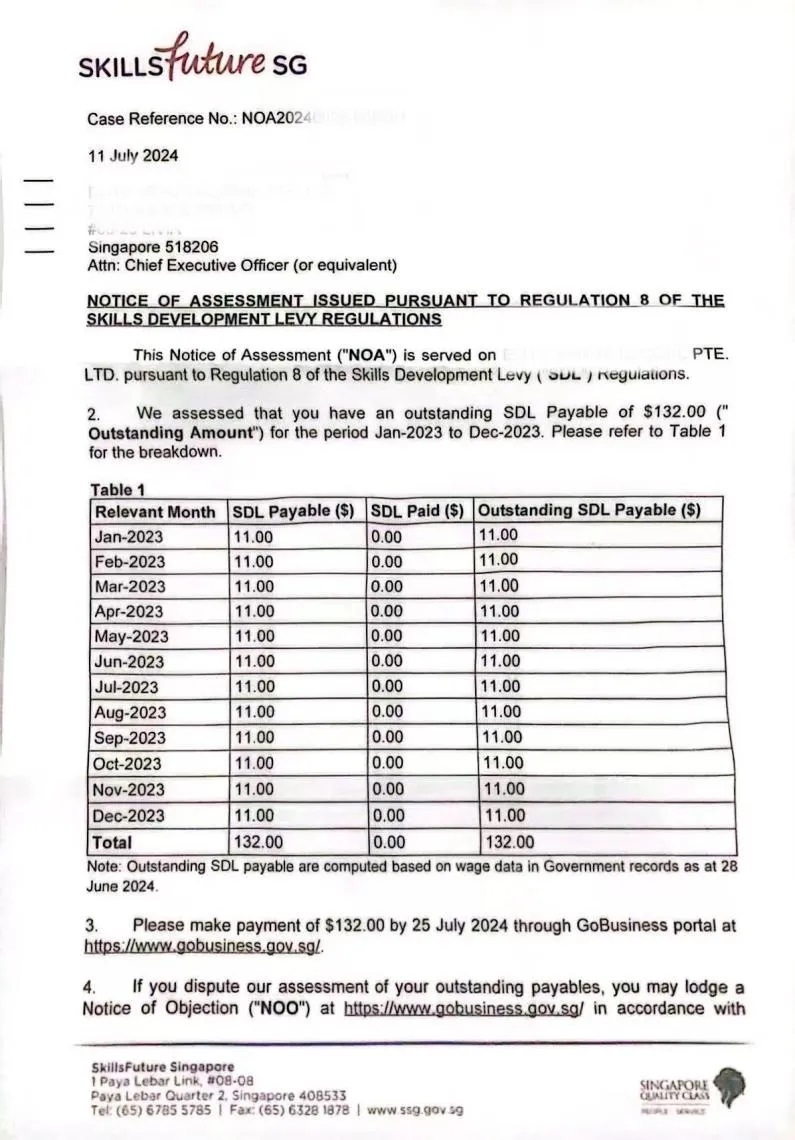

After you have calculated the SDL for each employee, you need to add up the total amount of SDL payable and round it up to the nearest dollar. The following table is an example of how to calculate SDL:

Doing business in Singapore, employers must remember to pay CPF and SDL to their employees in time. If you want to know more about Singapore labour law and dealing with salary payment in Singapore, welcome to consult us by private letter or message, we will work out the appropriate solution for you.