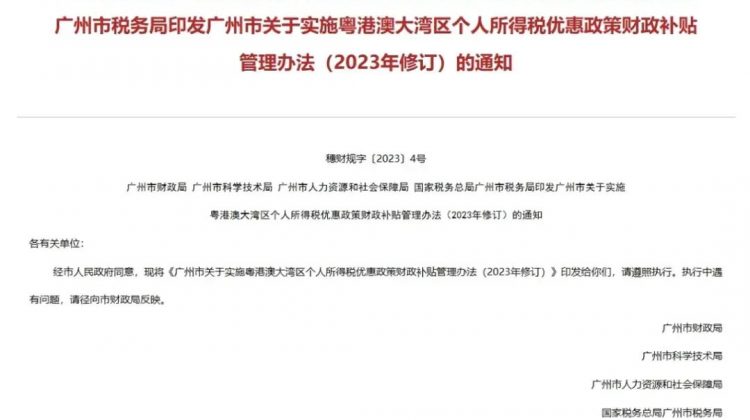

Overseas Talents Can Get Tax Subsidies in the Greater Bay Area!

The Guangdong-Hong Kong-Macao Greater Bay Area cities refer to the nine cities in the Pearl River Delta, including Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen, and Zhaoqing.Eligible overseas talents (including high-end talents and critically lacking talents) who work within the administrative area of the cities above-mentioned shall be given financial subsidies if their Individual Income Tax (IIT) paid in their cities exceeds the tax amount computed at 15% of their taxable income in the tax years of 2020, 2021, and 2022 (i.e., January 1 to December 31 of the respective calendar years). The subsidy is exempt from IIT. The maximum financial subsidy for IIT per taxpayer per tax year is RMB 5 million.

Income from Business Operation.

Income from Subsidies Supported by Talent Policies.

Recognized or assessed as high-level talents by the national, Guangdong province, or Guangzhou city talent authorities.

2 Enterprises of Key Development Industries Breakdown

3.Manufacturing and technology service enterprises.

Manufacturing service industries.

Modern service industries such as accounting, law, finance, consulting, research and development, design, commerce and trade services, advertising, media, cultural tourism, and other key development industries in Guangzhou and Guangdong.