Long Term Working in China, How to Deal With Income Tax?

Hi, guys

In the previous topic on personal income tax in China,

we discussed Kevin’s case as the example of non-resident individual.

This time, we will talk about Michael’s case.

Let’s take a look!

According to the “Implementation Regulations of the Individual Income Tax Law,” more details on personal income payment of individual resident. We conclude more details on personal income payment of individual resident as follows:

points that you need to know:

(2) Tax treaties give taxpayers preferential treatment, and taxpayers have the right to choose.

(3) The prerequisite for the application of the tax treaty is the taxpayer must be the tax resident of treaty nation.

The taxpayer is only a tax resident (resident taxpayer) of the other party’s contracting state and a non-individual resident in China (with less than 183 days of residence in the China within a tax year), the tax treaty can be normally applied.

A taxpayer who is a tax resident of the other treaty nation is also regarded as a tax resident of China, and it is necessary to confirm the tax resident status according to the permanent accommodation> important interest center> customary residence> nationality) as principal of Applicable tax treaties.

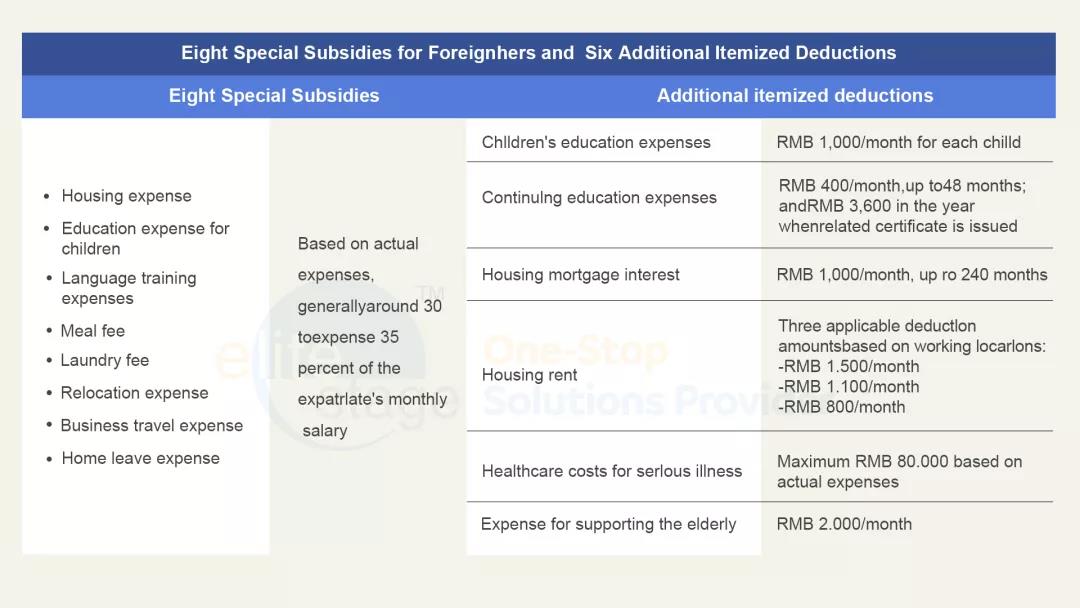

(1) Reasonable housing subsidies, food subsidies and laundry fees obtained in the form of non-cash or reimbursement.

(2) The relocation income obtained due to employment or resignation in China shall be reimbursed.

(4) Reasonable fees for visiting relatives (the place of employment is to take transportation in the place of the family, no more than 2 times a year.)

(5) Reasonable language training subsidies and child education subsidies.

Those expenses can be deducted from the taxable income in accordance with the regulations.

choose one tax subsidies out of these two

In addition, starting from January 1, 2022, foreign individuals, if no new policies are introduced, the eight subsidies might will be canceled.

Above content we mentioned is from a general point of view. In real practice, every specific case should be analyzed specifically.